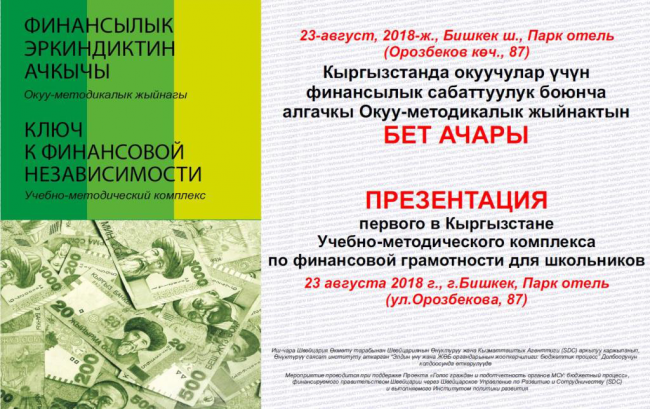

The first Educational and methodological materials on financial literacy for school students was published in Kyrgyzstan

Future of every young citizen in Kyrgyzstan largely depends on how competently she/he manages finances. Each of them can now set financial goals for themselves, decide what house they want to live in, what job to work, where their children will study, how they will plan vacation, and take care of their parents. To do this, one must gain not only knowledge of the school curriculum, but also very early learn to manage money, make savings, reasonably treat money. Then their future will be protected.

“The idea of developing this Educational and Methodological Materials (EMM) emerged in the summer of 2014, when the Development Policy Institute for (hereinafter - DPI) in the framework of the project financed by the Government of Switzerland “Voice of Citizens and Accountability of Local Self-Government Bodies: Budget Process” with participation of the Fund for Support of Educational Initiatives, Economics Department of the Moscow Institute of Open Education and the Club of Private Investors organized the Summer School “Municipalitet Fin Bilim City” aimed at stimulating engagement of teachers and school students in improving management of personal and public finances. During the summer school the structure and content of EMM was tested. Why should a student know about the school budget? One needs to learn about management of personal and public finances starting from the school. After all, financial literacy is necessary at all stages of life - from kindergarten to grave, and to fulfill all social roles - child and parent, student of school and college, employee and entrepreneur, healthy and sick, retired and artist. In each role every day we manage money, and our well-being depends on how well we do it,. Therefore, the Development Policy Institute with the mission to help local communities and self-governments exercise the right of every person to live with dignity, for several years has been undertaking great efforts to draw attention to the need of improving financial literacy of school students. So, from 2015 to 2018 with the support of the “Voice of Citizens and Accountability of Local Self-Government Bodies: Budget Process” Project, 64 schools received assistance to hold 72 public hearings on the school budget with participation of 33,116 people. These schools were provided with methodological assistance and promotional materials. The events were held during Global Money Week. There was a competition organized among the participating schools for the best public hearings on the school budget. Most of the activities were aimed at developing personal skills to manage personal and family money, also DPI helps school student understand the management of public finances. Therefore, at each school, public hearings or extended parent meetings on the school budget are mandatory. As a prize, the winning schools received materials and equipment that will help them continue programs to increase the financial literacy of students in the future,” noted Nadezhda Dobretsova, Chairperson of the Board of the Development Policy Institute.

The educational and methodological materials “Key to Financial Independence” was approved by the Academic Council of the Kyrgyz Academy of Education (excerpt from the protocol No.10 as of November 30, 2016) and recommended for publication and use in general education schools of the Kyrgyz Republic within the course “Individual and Society/Introduction to Economics” for extra-curricular activities at the expense of the school curriculum, as well as electives and clubs.

The EMM complies with the Standards of Basic Competences (knowledge, skills and behavior) on financial literacy for students of 5-11 grades of the secondary educational institutions of the Kyrgyz Republic approved by the Chairman of the Coordination Council for implementation of the Program for Raising Financial Literacy of Population of the Kyrgyz Republic for 2016-2020, by T.Abdygulov, Chairman of the National Bank of the Kyrgyz Republic on December 27, 2017.

The publication was developed in the framework of joint activities of the Development Policy Institute (DPI) and the Fund of Educational Initiatives Support (FEIS) and published with the financial support of the “Voice of Citizens and Accountability of Local Self-Government Bodies: Budget Process” Project financed by the Government of Switzerland through the Swiss Agency for Development and Cooperation SDC) and executed by DPI.

What does EMM consist of?

- Workbook (ISBN 978-9967-9124-2-7) is an integral part of the educational and methodological materials (EMM) “Key to Financial Independence”. Its content corresponds to the textbook and the instructional Manual for teachers with a similar title. The workbook is designed to help senior students and includes practical tasks to do in the classroom and after-school hours. The workbook is intended for students of 10-11 grades and their teachers in the secondary schools of the Kyrgyz Republic to learn the basics of financial literacy within the school curricula and as an additional manual for the integrated course “Individual and Society.”

- Textbook (ISBN 978-9967-9124-1-0) discusses issues of financial literacy, personal financial security, effective money management, citizens' interaction with financial institutions, forming personal finance management skills and developing financial projects.

- Instructional manual (ISBN 978-9967-9124-0-3) is an integral part of the educational and methodological materials (EMM) “Key to Financial Independence”. Its content corresponds to the Textbook with a similar title and the Workbook for students of 10-11 grades. Teachers are offered with methodical recommendations, which allow to effectively conduct classes with the senior students during and after school hours.